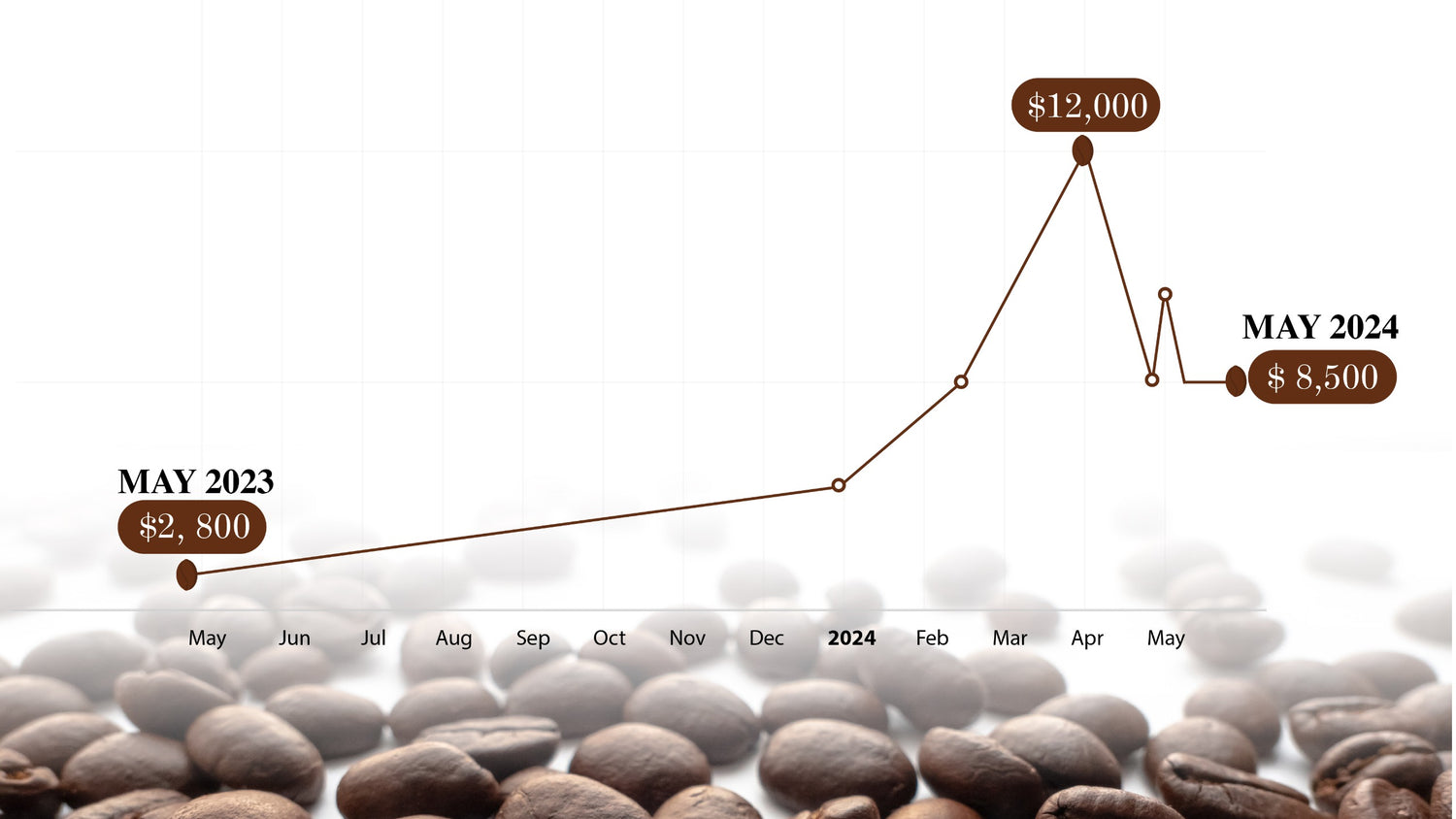

Cocoa prices are fluctuating and how!

To put things into perspective, the price of cocoa beans a year ago was around $3,000 (USD) per tonne. Cut to today, the number has above $8,500!

Side note: It even peaked at a record high of $12,000 in mid-April this year. That’s almost a 300% jump in cocoa prices in just a year.

There has to be something really crazy going on in the cocoa industry to explain this bizarre price surge, right? If you understand basic economics, you know this price hike is because of an apparent massive shortage in cocoa beans supply.

To put this in numbers- The International Cocoa Organisation (ICCO) expects global cocoa production will fall by 10.9% to 4.45 million metric tons this season.

And, this dramatic reduction in cocoa bean production has led Ghana- the second largest cocoa-producing country to repeatedly suspend work for weeks for most cocoa processing plants, including the state-owned Cocoa Processing Company (CPC), since the start of the season. CPC said it is operating at about 20% of capacity because of the shortage of beans

But what’s causing this sudden shortage?

Let’s look at what’s really happening in the cocoa world, shall we?

- Climate Change Chaos

It's 2024 and climate change isn’t a joke anymore. El Nino, a consequence of climate change that causes disturbed weather conditions struck the world’s top cocoa-producing countries in Western Africa this year.

This led to extreme flooding followed by severe droughts and wreaked havoc on cocoa plantations. To anyone who doesn’t know how cocoa is produced, it is a highly climate-sensitive crop, and without ideal weather conditions, it won’t thrive.

And, this year’s too-hot and too-humid temperatures in Western Africa not only disrupted the production cycles but also aggravated plant diseases like the ‘Black Pod Disease’ among cocoa trees which further declined its production.

- Broken Structures

The cocoa industry to this day remains largely underinvested. And since small farmers own the majority of the cocoa farms, they lack the financial power to re-invest in their land.

To make things worse, there have been very few re-plantations of cocoa trees over the years and most of the trees currently are age-old, leading to further lower yields each year.

Additionally, the cocoa industry is notorious for employing child labor and underpaying its farmers. However, in recent times, there has been an attempt to adopt more ethical and sustainable practices by cocoa-producing countries which again further raised its prices.

- Hedge Fund Investors & Price Manipulation

While the above-stated factors are a known fact and have existed for a while now, they still don’t fully justify the 3x times rise in price in just over a year.

So what else or rather who else is fuelling cocoa prices?

Enter the Hedge Fund Mafia/ or whatever you want to call a bunch of people wanting to make profits by driving up cocoa prices.

To understand this context, let’s first see how cocoa is traded in the finance world. Cocoa prices are known to fluctuate, this can be because of weather disturbance, supply chain issues etc.

And big confectionery companies like Hershey’s, Mondelez, etc. who are extremely dependent on huge and steady supplies of chocolate secure themselves against these price fluctuations by buying ‘future contracts’ of cocoa.

Under future contracts, buyers and sellers of cocoa set a fixed price for cocoa beans which secures them for future price inflations. It's like pre-ordering your cocoa beans at a set price to avoid potential future increases.

Circling back to the hedge fund angle, numbers show that cocoa prices had steadily been increasing towards the end of 2023 due to climate change effects and other plant diseases. And, between October and the end of December U.S. Cocoa futures had already gained 23%, breaking the previous record high of $3,826 per tonne.

This is when hedge funds, whose equity short bets didn’t perform well during the recent stock market rally, decided to get a piece of pie from the cocoa market.

According to a New York Times article- in January, the number of active cocoa contracts jumped 30 percent from the year before, data from the Commodities Futures Trading Commission show. But that trading volume fell sharply starting in April — as prices peaked — and the smaller number of trades resulted in big price swings in the past two weeks.

Furthermore, in speculative positioning across commodity markets in New York and London, traders — including hedge funds — have built up a massive $8.7 billion position, the largest ever in dollar terms, according to data from the Commodity Futures Trading Commission.

Pierre Andurand, a major player in the commodity trading world, reportedly purchased significant quantities of cocoa futures earlier this year.

According to a Bloomberg article, he bet on cocoa earlier this year and saw the trade pay off as the price of the beans surged to a record $12,000 a ton. Andurand also said “If the weather fails to improve, cocoa futures could jump to more than $20,000 this year or the next”.

TWENTY THOUSAND DOLLARS!

Yikes!

(It’s important to note that statements like these coming from influential people in the commodity market only add fuel to fire.)

This is also reminiscent of 1977, where cocoa prices fluctuated to $5000 per tonne which in today’s time would amount to around $28,000!

Well, we can only speculate at this point but it’s hard not to believe that these financial agendas have made the situation seem more scary and panicky than it already is.

Additionally, since we at Pascati work closely with cocoa farmers, we know that the ground reality is not as frightening as it seems. During several conversations with local farmers, we found out they are more interested in future prices than any stock shortage that the whole world is talking about.

“Yes, there are fundamentals that trigger the move, but then these financial considerations add to it and compound the situation,” said Judy Ganes, a commodities consultant. “It’s money-driven.”

Luca Zaramella, the chief financial officer of Mondelez, told analysts on April 30 that the market was “overreacting” and that it would very likely correct itself in the latter half of the year.

What is Pascati doing while the storm lasts?

Well, there are only 3 ways for chocolate brands to go about this cocoa crisis

- Shoot up the price

- Reduce the size

- Do both of the above

And we at Pascati have zero compromises on quality policy. We also feel there’s no need to press the panic button as of now and though the cocoa prices are psychotic right now, we are ready to take a hit for a while.

But

If the cocoa prices keep rising to the point where we can’t absorb the cost anymore, we will have to pass down some costs onto the consumer because we sure aren’t downgrading the quality regardless of whatever happens.

Stay strong chocolate brands!